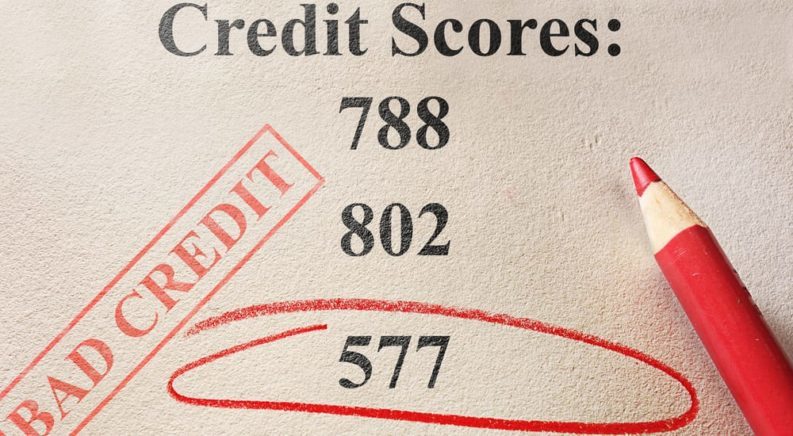

Sometimes, bad things happen to good people. You have an unfortunate life incident and your credit takes a hit. It is in a regrettable fact of life that many of us have or will eventually face. And all too often, we don’t realize how badly these situations can affect our credit. Even still, life has to move on and you have to try to build yourself back up. Buying a new car is already a difficult process, even if you don’t have bad credit. Car dealerships are hesitant to work with someone they fear cannot or will not pay their car loan.

However, there are some car dealerships out there that understand some people have had to start all over. Bad credit is just an inconvenient part of their story, and it does not define them as a person. These car dealerships will work with those people and get them into a new or pre-owned vehicle. It does come at a price, though.

For starters, you will need to show proof of employment. This proof will have to extend back some time, usually a minimum of six months. This shows the dealership that you do have a job and that you have held said job for some time. This shows hard work, initiative, and consistency. Those are all traits that will lend well toward an extended line of credit.

You will also need to have a minimum monthly income. This number will vary widely from dealership to dealership. It will also fluctuate based on the type of vehicle you are trying to obtain. Obviously, a newer year model will have a higher sticker price than an older one. A pre-owned vehicle will also have less stringent criteria for ownership and a credit line.

Having a monthly minimum income will show the dealership how much you are willing and able to spend. Experts say that your rent or mortgage should be approximately one-third of your monthly income. That leaves plenty of room for things like utilities, groceries, cell phone payment, car insurance, and spending money.

You will have to adjust your budget with a new monthly car payment. Unfortunately, that will be most directly affecting your spending money. However, it is a necessary evil, as having a reliable means of transportation is essential to most working men and women.

When explaining your budget to the finance team member at your local dealership, it is important to be completely open and honest. If you try to report that you make more money than you really do, or that you don’t spend as much money as you really do, you are only doing yourself a disservice in the end. You will end up short on your car payment (or utility, rent or grocery funds) and have your car repossessed for non-payment. This will have an extremely negative impact on the credit you have worked so hard to build back up. In the end, it is far better to be honest and get a more affordable vehicle than to fudge your statistics and end up over your head with bills.

If you are still confused as to how to build your credit back up before making that jump to car ownership, try these tips out.

Paying your bills on time is the best indicator to credit agencies of your ability and willingness to pay your bills. That includes everything from rent to power to water and credit cards. All of the people or businesses that you pay monthly bills to have the power to positively and negatively impact your credit score. Keeping in the good graces of landlords and utility companies, you are showing the credit agencies you are trying your best to be responsible with your finances.

There are some credit card companies that will allow you to take out credit cards, even with poor credit. The biggest drawback is that you will pay an extremely high interest rate. If you can manage to take out one or two of these credit cards and use them very sparingly, while still paying your monthly bill on time or early, this tactic will go a long way in improving your credit score in a relatively short time span.

Be careful, though, not to go crazy on opening credit cards. Opening too many lines of credit in a short time sends an alarm to those agencies. It may look as though you are desperate for cash now (which you may very well be) or open to the idea of taking on a lot of credit debt very soon. These actions make lenders a little hesitant to extend any lines of credit.

Many banks also offer what they call secured credit cards. You can open what is effectively a debit card using a couple hundred dollars of your own money. This money is put into a credit account that offers increasingly high limits with successful monthly payments. This is a good way to build credit using the money you already have, and you don’t have to start with much. Check with the bank you already have an existing checking account with. They are much more likely to work with you than a bank that has never held any of your money.

Bad Credit Car Dealerships And Repairing Your Credit

The most important thing to remember is that establishing or re-establishing good credit is a long process. It will take time. It will take a lot more time than whatever it was in your life that plummeted your credit score. It is frustrating and seems unfair, but it is just a fact of life. Think of it in terms of a race. You are in for a marathon. You may want it to be a sprint, you may want the finish line to come sooner rather than later. It will come, but it could be years down the road.

Using these tactics will go a long way towards raising your credit score to an acceptable rate to get a loan or finance a car payment. However, you have to stick to your financial plan and budget. Being a few days late on a payment is not the death knell for you, but you need to stay in contact with those who you pay bills to. If you are going to be late with your power bill, call them and tell them. Set up a future “pay by” date and stick to that date.

It may feel like juggling, and it may at times feel like the bills are starting to get out of your control. But, be patient and keep the juggling balls in the air. Eventually, you will realize that the juggling gets easier and more manageable. Once you get more comfortable with what you already have going on, you can add more responsibilities.

Don’t hesitate to reach out to your local car dealerships or even an online car dealer. They want to get you into a new car. Even for those with bad credit, car dealerships still have vehicles to move and customers to serve. You will find one that will be willing to work with bad or non-existent credit. And you will be surprised at how far they might be willing to go to help you get back on your feet.